In the international supply of oilseeds, although only a limited number of countries have supply capacity, demand exists in all countries. As a result, there is increasingly severe competition among demand countries for the limited supply amount. In particular, in the 2000s, in addition to demand for conventional food products and industrial products, new demand arose in the form of biofuel. Demand continues to increase at a fast pace.

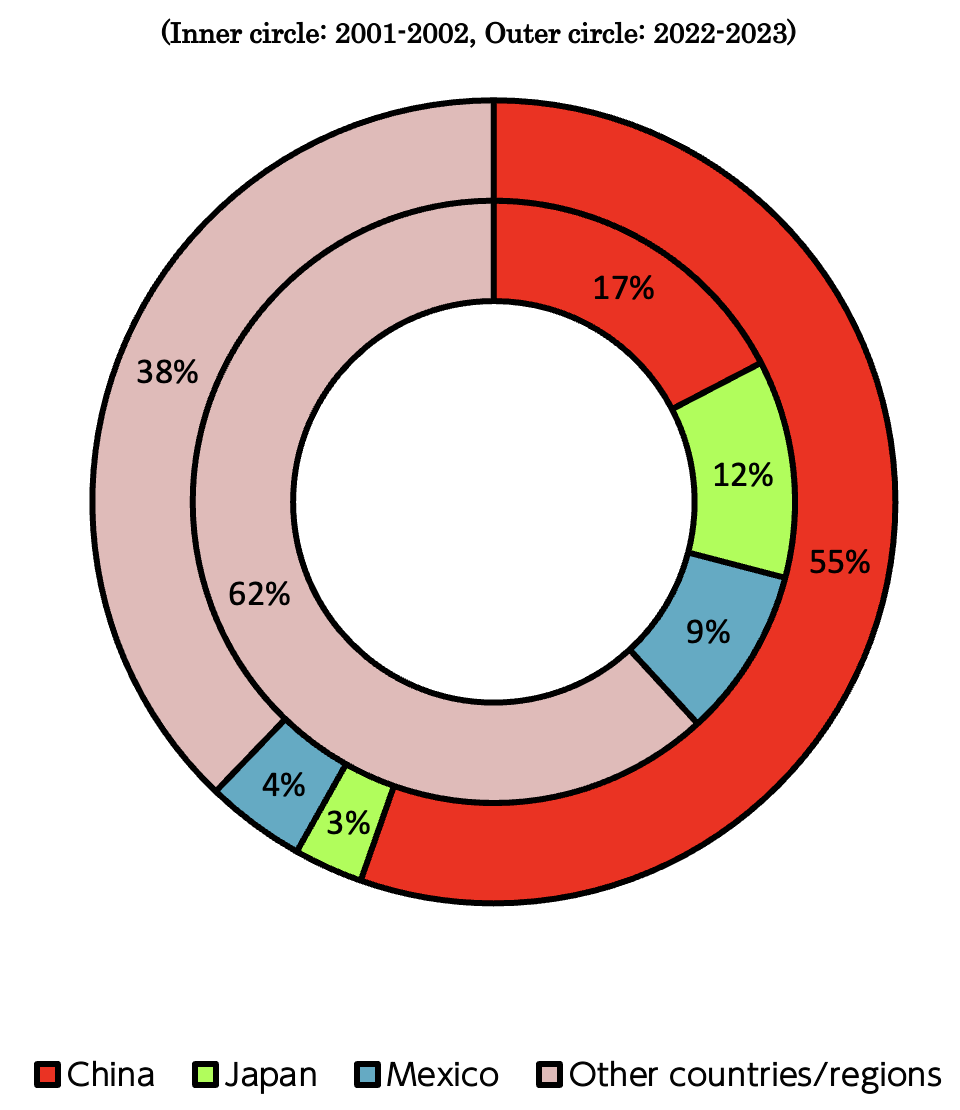

Changes in import amount for each type of oilseed has followed essentially the same track as changes in the export amount. A noteworthy phenomenon in oilseed imports is how the importing countries have changed significantly over the past ten years or so. Figure 4 shows the ratio by oilseed importing country in 2001-2002 and 2022-2023. Until the mid-1990s, Japan was the world's largest importer of oilseeds. However, China took the lead in the 2000s. Recently, China accounts for more than half of global oilseed imports.

Figure 4: Changes in ratio by oilseed importing countries (for 10 main types of oilseeds)

Source: Same as Figure 1

Note: Import amount was 64,336,000 tons in 2001-2002 and was 201,575,000 tons in 2022-2023

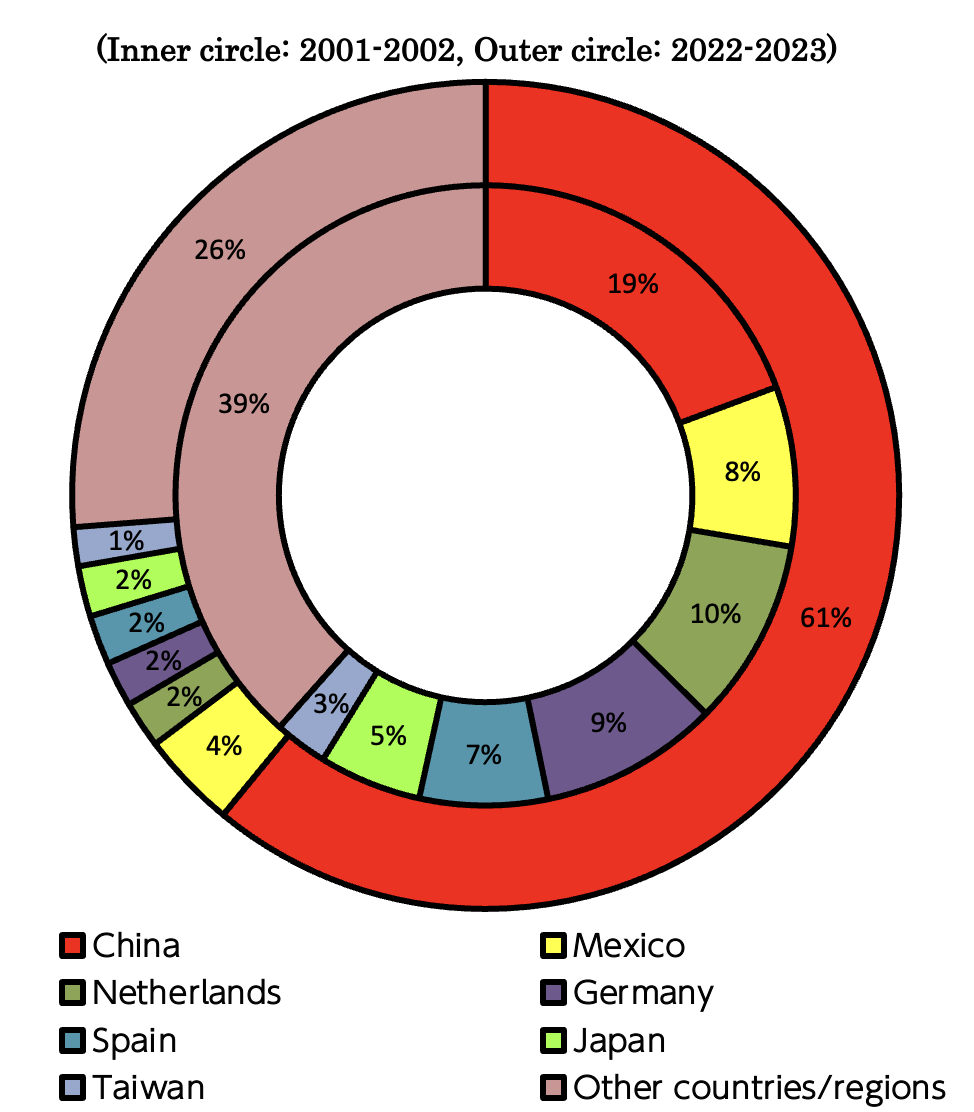

In particular, major changes occurred in soybeans. Until now, China accounted for approx. 60% of the global import amounts (see Figure 5). China is the world's fourth-largest producer of soybeans. In the mid-1990s, China became a net exporter (country where exports exceed imports) of soybeans. However, in conjunction with a rapid increase in demand for oils/fats and meats, there has been increased demand for soybean meal which is the raw material for oil/fats and high-protein feed. Conversely, domestic production of soybeans has stagnated, so it has become necessary for China to import soybeans, other oilseeds, and vegetable oil in order to satisfy the vast domestic demand. Accordingly, China shifted to a net importer of soybeans from 1996, and shortly afterwards became the world's largest importer of soybeans. In anticipation of these changes, from the mid-1990s, holders of the world's oil-producing capital invested in the construction of plants for soybean oil extraction in coastal regions of China. Domestic Chinese oil-producing corporations also followed suit. As a result, China's oil extraction capacity is now equivalent to more than 100 million tons of soybeans.

The amount of soybeans imported by China exceeded 50 million tons in 2009-2010. In fiscal 2022-2023, this amount reached 102.57 million tons, which is approx. 60% of the amount of global trading. The demand for oil/fat and meat in China is forecasted to grow even further in the future. Accordingly, an even greater rise in the soybean import amount is also forecasted.

Figure 5: Changes in ratio by soybean importing country

Source: Same as Figure 1

Note: Import amount was 53,762,000 tons in 2001-2002 and was 168,290,000 tons in 2022-2023

Even in the case of rapeseed, China has experienced repeated large fluctuations in imports. Each time, the international market was affected. Previously, the production of rapeseed oil in China was normally conducted via oil expression of domestic rapeseed in small plants in inland China. However, in the same way as soybeans, large plants have been built in coastal regions and imported rapeseed is now used. The amount of rapeseed traded is not as large as for soybeans. Therefore, fluctuations in Chinese imports have a significant effect on international prices.