What are the characteristics for trading of oilseeds, in other words, international distribution?

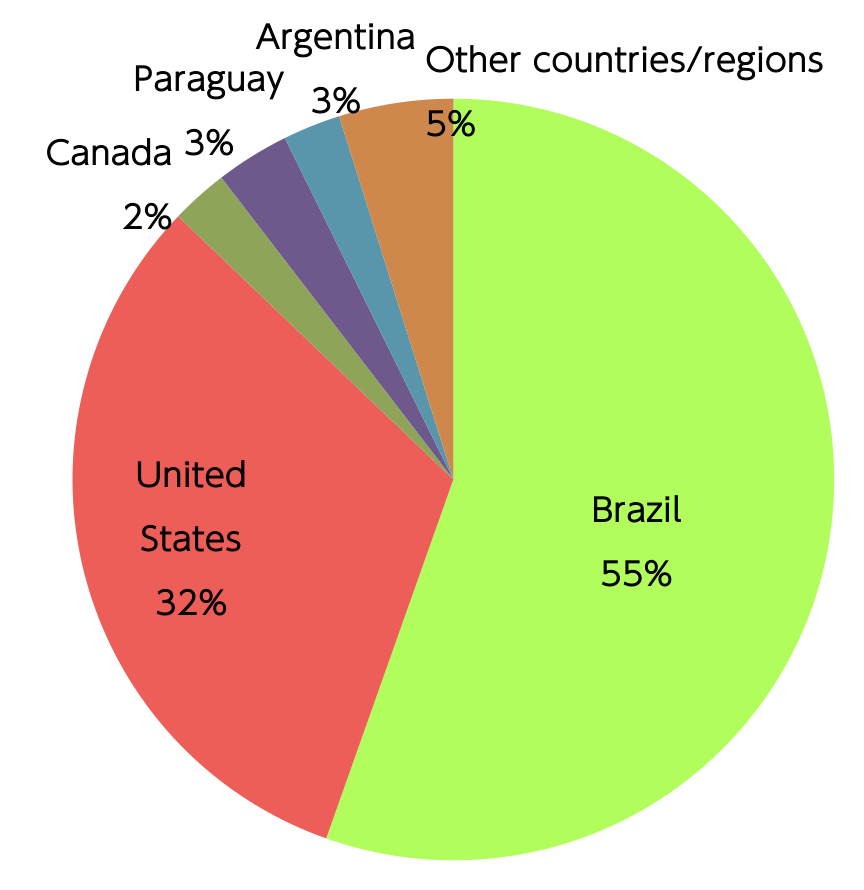

The first characteristic is that only certain countries are capable of supplying oilseeds to other countries. We will now examine soybeans, which easily lead all other oilseeds in terms of production amount and trading amount. As shown, in Figure 2, China and India are major producers; however, these two countries lack the capacity to supply to other countries. In particular, China is the largest importer of soybeans in the world. Brazil and the United States are the two major countries capable of exporting large quantities of soybeans in large quantities, followed by Canada, Argentina, and Paraguay, with fluctuations among the countries each year. Together these five countries account for more than 90% of the world's soybean exports.

Figure 3: Ratio of soybean exports by country (2022-2023)

Total export amount: 172,324,000 tons

Source: Same as Figure 1

However, there are differences between each of the exporting countries.

The United States has long been known as the "bread basket of the world." It has fulfilled the role of supplying countries through the world with soybeans, corn, and other crops. The United States continue to hold this position and exports soybeans to numerous countries.

Conversely, soybean production in Brazil and Argentina has expanded rapidly from the 1990s. Brazil has succeeded in producing soybeans in barren regions known as the Cerrado. Argentina has started producing soybeans in large plains known as the Pampas. In particular, Argentina has positioned soybeans and related industries as a national strategic industry. The country is working to expand soybean production and construct oil-producing plants. In particular, Argentina is also expanding the export of the processed products of soybean oil and soybean meal, and is implementing a discriminatory export tax system as an industry strategy for securing even more added value within the country. Consequently, the export of soybeans from Argentina is decreasing in comparison to the production amount.

Previously, Brazil had implemented discriminatory export policies similar to those in Argentina. However, in the mid-1990s, Brazil revoked these tax policies and increased the export of soybeans. Brazil is now a soybean exporter on the same level as the United States.

Trends are even more extreme in the case of rapeseed. Compared to soybeans, the global market for rapeseed is small. The only countries with export capacity were Canada and Australia; however, the export capacity of Ukraine is increasing in recent years. In the EU, countries such as Germany and France are large producers of rapeseed. However, as a whole, the EU lacks production to satisfy demand. Consequently, it is necessary to import from nearby countries such as Canada and Ukraine. Australia produces a small amount of rapeseed and its export capacity had fluctuated greatly depending on climate changes, but Australia’s production amount is increasing in recent years. Canada’s share of export capacity is trending downward in recent years, but its supply capacity continues to have a substantial effect on the international market.

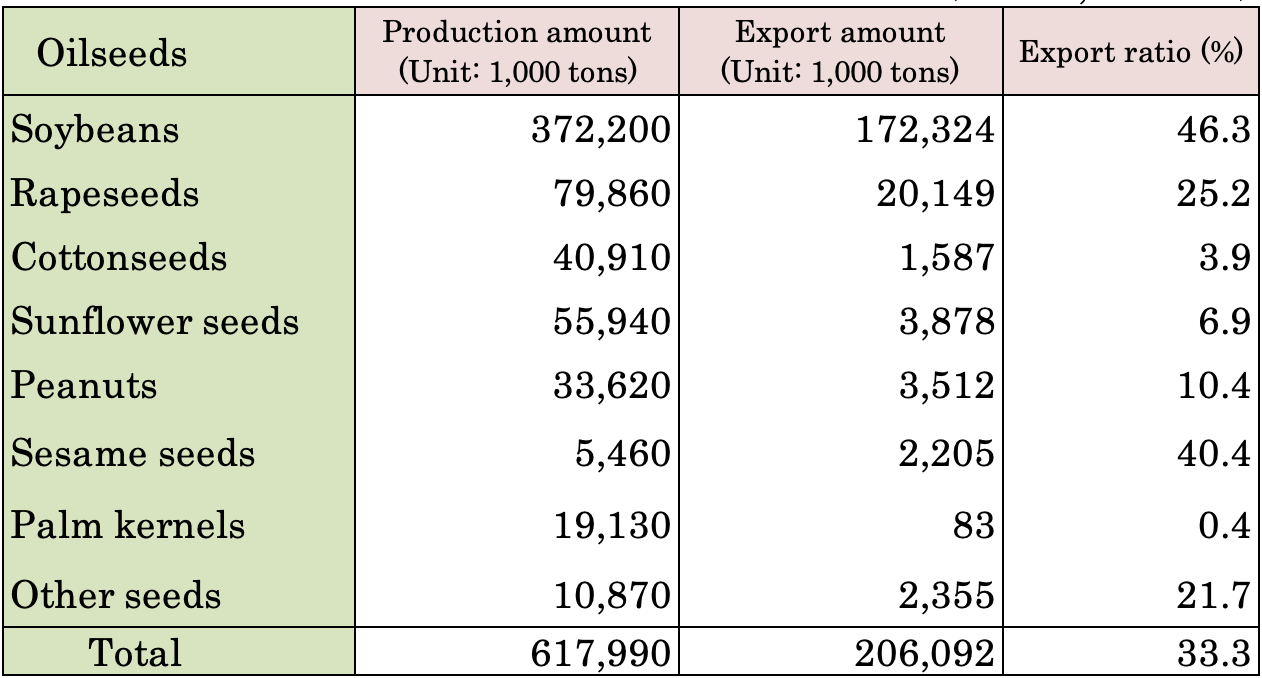

The other characteristic is shared by almost all crops: there is a low ratio of trading amount in relation to the production amount. The production amount of oilseeds (total of 10 types) in 2022-2023 was 617.99 million tons and the trading amount (export) amount was 206.09 million tons. This means that the total amount of global trading is 33% of the production amount. This ratio was around 20% in 2001-2002, which indicates that exporting countries have increased the export amount in conjunction with growing import demand. The majority of this increase was due to increases in soybeans. Soybeans account for more than 80% of the oilseed trading amount and has an export ratio of approx. 46% relative to production. As such, soybeans have a high export rate among other agricultural crops. During the same period, the production amount of rapeseed expanded to around 3-4 times; however, the export ratio relative to production is 25%. Also, as stated earlier, sesame seeds are mainly produced in developing countries. These countries position sesame seeds as an important export product and are promoting exports. Therefore, these countries have a high export rate relative to production.

Table 2: Production and export of oilseeds (2022-2023)

Source: Same as Figure 1

Based on the two characteristics explained above, if production decreases drastically due to droughts and other climate fluctuations, exporting countries must give first priority to satisfying domestic demand. Therefore, the amount of oilseeds designated for export will decrease significantly. This will create a drastic feeling of stringency among international supply of oilseeds, thus causing prices to increase. In particular, in conjunction with the growing demand of oilseeds, there are frequent cases in which changes in production will cause radical price fluctuations. The first times that the production of soybeans decreased due to inclement weather (drought) in main producing countries were in 2008 and 2012. More recently, this also occurred in 2021 and 2022. Furthermore, due to the impact of the political situation caused by the Russian invasion of Ukraine, the feeling of tightness in international supply and demand increased. As a result, the international price of oilseeds hit a record high or rose to a close level. Afterwards, although prices showed signs of decreasing, they remain at a high level.