Generally speaking, global prices for oilseeds and vegetable oil are determined by international supply and demand. However, a giant market where all products are traded does not exist. Instead of just actual supply and demand, opinions of market participants regarding supply and demand have a significant effect on price formation. Also, global investment sometimes flows into the agricultural market and is sometimes withdrawn. This irregular flow of funds also effects price formation.

Although the commodity exchange with global authority differs depending on the product, in the case of oilseeds, the Chicago Board of Trade (CBOT) has the greatest influence. The CBOT simultaneously lists soybeans, soybean oil, and soybean (sometimes collectively referred to as the "three soybeans") and forms the price of futures. Prices on commodity exchanges are thought to be influenced by the following factors.

1) Intersection of opinions on supply and demand between buyers and sellers.

2) Relationship with other agricultural crops. Production regions for soybeans are also used as production regions for wheat and corn. Therefore, in general, soybeans prices are linked with the prices of the other crops.

3) Trends in oilseeds and vegetable oil other than soybeans.

4) Trends in investment funds. This influence increases during periods when the financial market is unstable.

5) Relationships with petroleum products. In conjunction with the rise of biofuels, this element has also begun to effect prices.

Basic supply and demand are affected by information at that moment. Information affecting demand includes purchasing trends in major importing countries. Information affecting supply affects trends in the planting of oilseeds, the germination and initial growth, weather conditions from growth until harvest, information on the harvest area, and information on the harvest amount. Price formation sometimes changes greatly due to long-term weather conditions from the period of initial growth. This phenomenon is referred to as the "weather-driven market." The United States Department of Agriculture (USDA) issues a monthly report that also significantly affects the market.

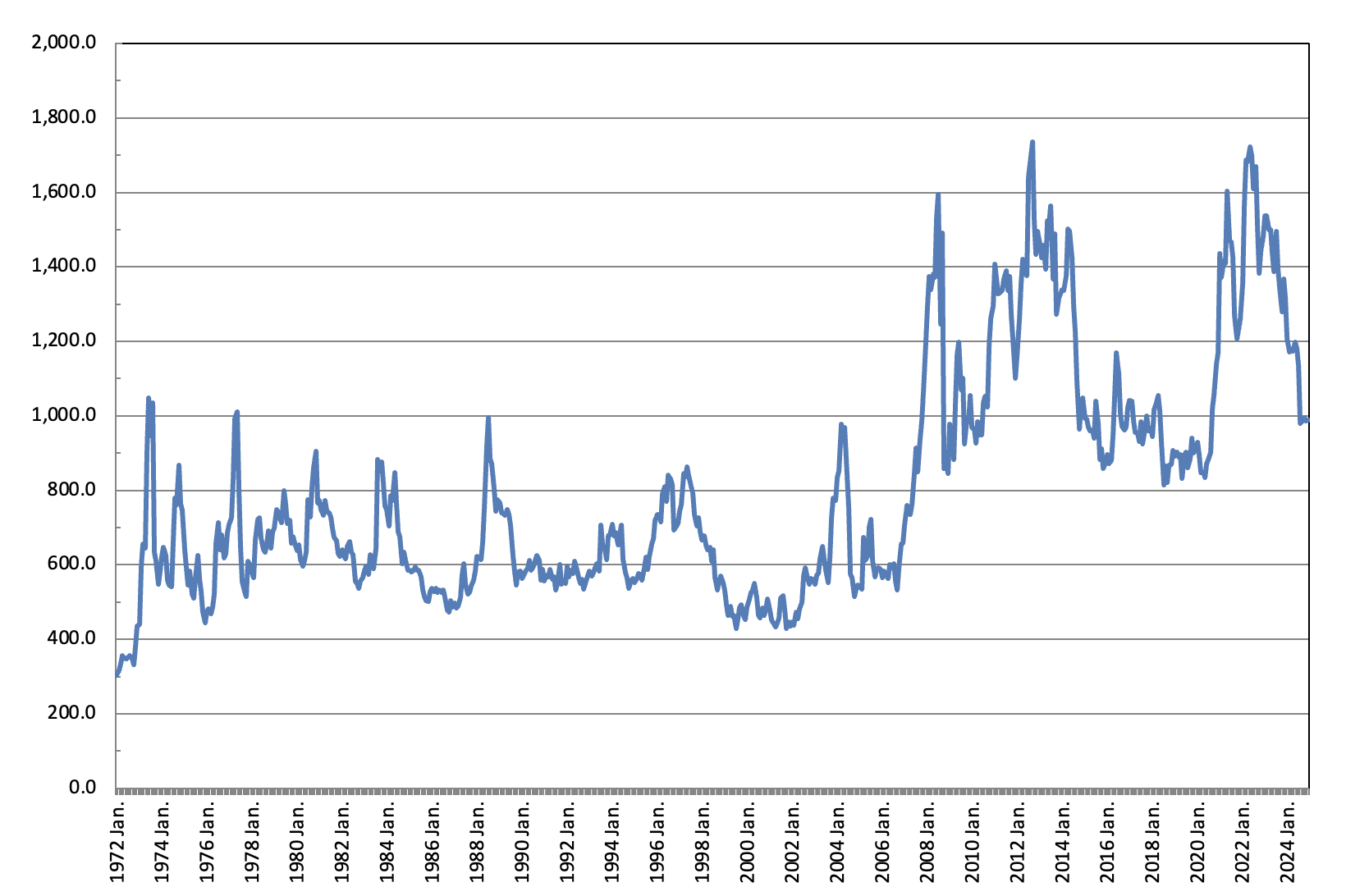

In 2012, the major soybean producing regions of South America and the United States were struck by a severe drought. This increased the feeling of tightness in supply and demand, and soybean prices on the CBOT reached a record high in September of the same year. Similarly, from 2021 to 2022, prices rose due to the factors such as the increase in demand for food and biofuel, the poor harvest in 2021 for rapeseed produced in Canada, the decrease in palm oil production because of the shortage of workers caused by COVID-19 and the situation in Ukraine in 2022. Prices began to decline in the second half of 2022. Although 2023 and 2024 also showed stabilization at low prices, prices remain at a high level compared to before 2020.

From among the three soybean products listed on the CBOT, Figure 14 shows prices for soybeans. From the past until today, the factors listed above have caused severe price fluctuations. When observing price trends until the early 2000s, you can see that prices always returned to the original level even after rising temporarily. However, upon entering the 2000s, prices did not return to their original levels after rising; instead, prices rose in steps and maintained a high level. In principle, the CBOT determine product prices based on trends in supply and demand. Another issue in determining prices is how to reflect increased costs incurred by farmers. Some analysts believe that the reason that prices did not return to their original level after rising in the 2000s is because of increased production costs incurred by farmers.

The prices formed by the CBOT affect the prices of rapeseed and other oilseeds, as well as the prices of palm oil, etc. In this respect, the CBOT prices for the three soybean products can be called the bases for price foundation for other oilseeds and vegetable oil.

Moreover, in principle, the prices for the three soybean products are formed based on supply and demand factors. It is possible to theoretically calculate the amount of gross profit earned by expression a bushel of soybeans and selling the product as soybean oil and soybean meal. This enables comparison for the selling prices of soybean oil and soybean meal. The former is called the "board margin," while the latter relative relationship between soybean oil and soybean meal is called "oil value" or "meal value." The expression profitability and market conditions at the applicable point in time are also a basis for determining prices.

Figure 14: Changes in soybean prices on the CBOT

(Unit: cent per bushel)

Source: Chicago Board of Trade

Note: The graph lists prices on the settlement date of the delivery month (final prices).